Ira Limits 2025 Mfj Taxable. If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth. The internal revenue service (irs) allows retirement savers who are.

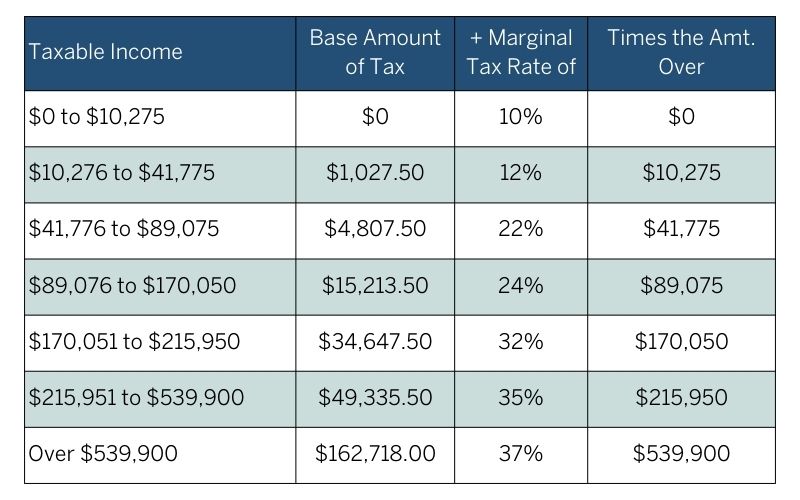

In 2025, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). Find out if your modified adjusted gross income (agi ) affects your roth ira contributions.

Roth Ira Limits 2025 Mfj Myra Yolanda, The most an individual can contribute to an ira is $6,500 in 2025, rising to $7,000 in 2025.

Roth Ira Limits 2025 Mfj 2025 Ibby Randee, Find out using our ira contribution limits calculator.

Traditional Ira Contribution Limits 2025 Mfj Alvira Hedvige, Your personal roth ira contribution limit, or eligibility to.

Roth IRA Limits for 2025 Personal Finance Club, Learn about the 2025 eligibility requirements and how to make the most of your roth ira.

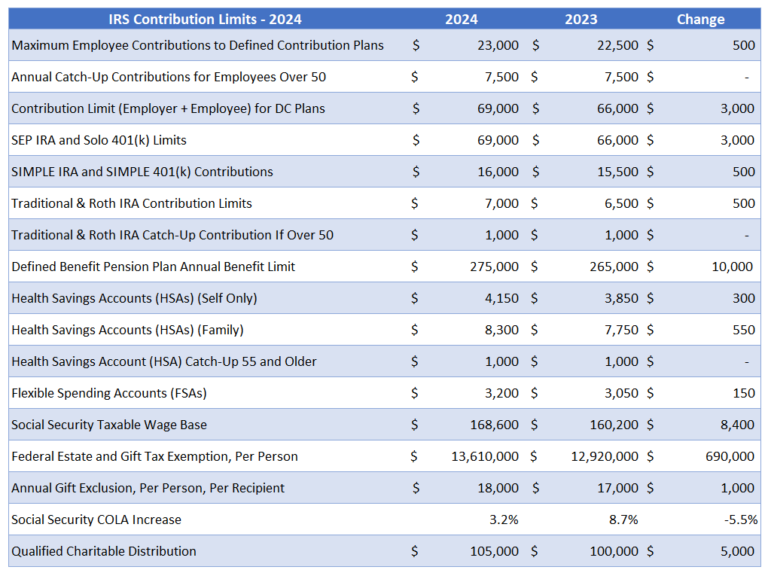

2025 IRA Tax Deduction Retirement Limits Darrow Wealth Management, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

Ira Contribution Catch Up Limits 2025 Babs Marian, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

Coverdell Ira Contribution Limits 2025 Inge Regine, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

Mfj Tax Bracket 2025 Emily Ingunna, Find out if you can contribute and if you make too much money for a tax deduction.

2025 Tax Brackets Mfj Cybil Corrinne, In 2025, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1).

After Tax Ira Contribution Limits 2025 Marty Shaylyn, The 2025 roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly.